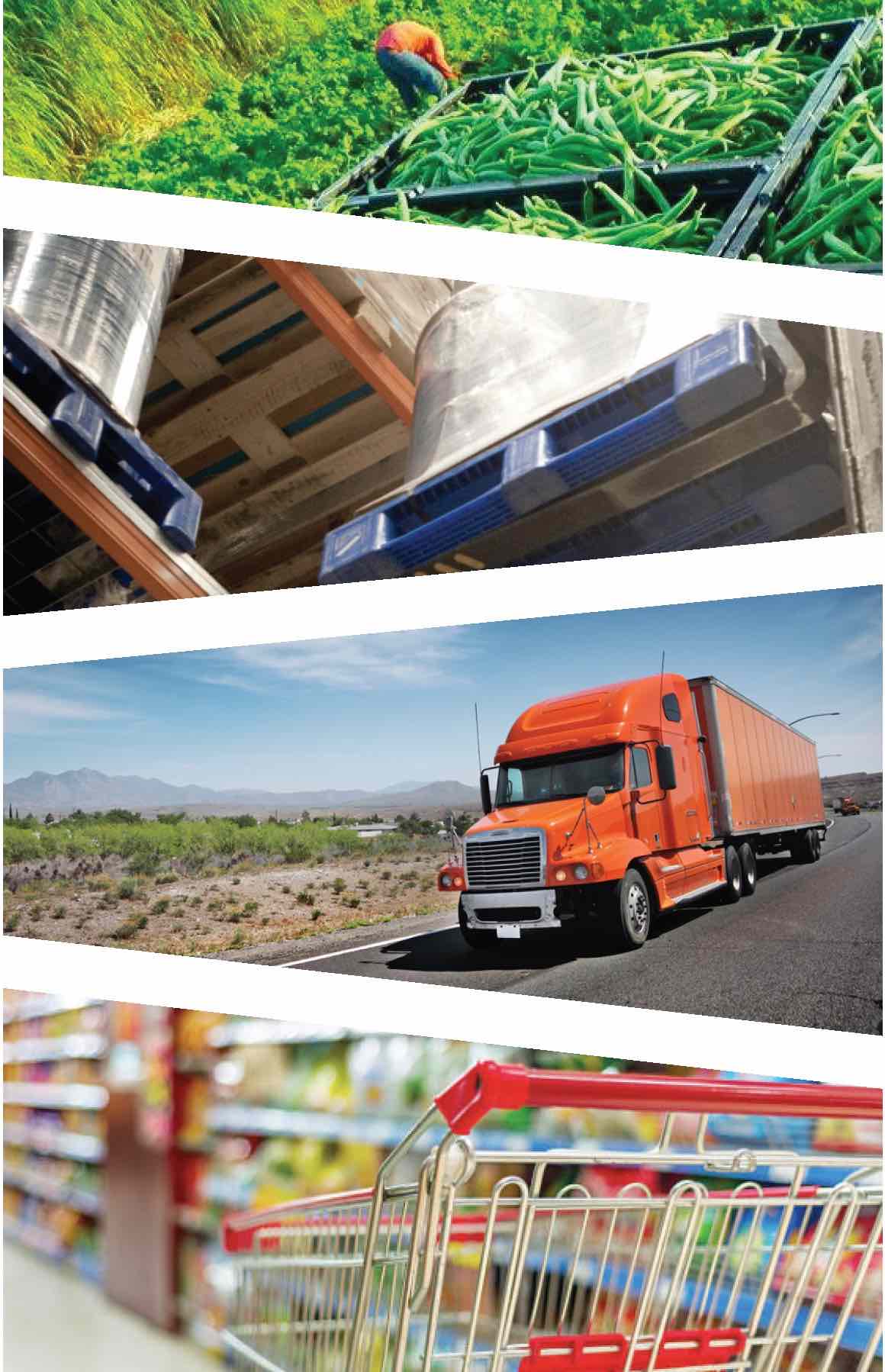

Scaling risk and opportunity in supply chain integration

As retailers continue to optimize their supply chains in the relentless and necessary pursuit of profit and efficiency, more and more of them are architecting increasingly captive, vertically integrated supply chains. Consumers demand more transparency, quality and consistency. And retailers need unprecedented control and predictability over demand, cost, velocity, distribution and waste. For many retailers, the changes required to drive real improvement can be costly and risky but the tradeoffs and investment can be well worth it.

The move of “big retail into big ag” is becoming the norm with players like Walmart, Albertson’s and Costco making bold moves to bring more of their supply chains in house. In some cases, these changes can cost millions. But they can result in big strategic benefits as they allow companies to be more agile in making operational changes and applying new learnings and innovations.[1]

Integration can also help retailers engage emerging suppliers to ensure future pipeline and take more control over demand. It also lets them test, fail and refine faster and generally be more responsive to market changes at a tactical level. For instance, the conversion or retooling of facilities is much easier for retailers who have end-to-end control over their own supply chain.

Who’s making major moves: big-brand examples

Costco: creating more control over its access to whole chickens.

While whole rotisserie chickens became one of the retailer’s most popular products selling at the rate of 90 million per year growers began to shift toward selling chicken mostly in large parts. Costco needed a reliable supply of whole chickens, and thus broke ground on a $400 million processing facility.

Walmart: building and refining supply chains in Angus beef and dairy.

In order to drive greater quality, transparency and stability in its beef supply, the retailer is partnering with select partners to offer select beef cuts in 500 stores across the Southeast. They’re also streamlining their milk supply chain, cutting out middlemen and building their own milk processing plant to serve Walmart stores in the Midwest. [2]

Kroger and Albertson’s: investing in milk processing and multi-use bottling facilities to satisfy customer demand for milk and dairy.

Albertson’s saw the move as enabling them to be more adaptable in catering to their core customer base, which still seeks these products despite general shifts in the U.S. toward plant-based derivatives. But Albertsons sees a lot of potential opportunity for this investment, as the senior vice president of manufacturing, Evan Rainwater, told The Wall Street Journal, “You can do a lot more in a dairy plant than make dairy.” [3]

Switching to vertically integrated supply chains takes a lot of planning and work. Retailers making this decision should evaluate other optimizations that can be made during the transition to further optimize the supply chain while offsetting some of the cost of the integration.

Opportunities during supply chain evolution

Making a big change like vertical integration creates opportunities to find other ways to optimize as you rebuild a supply chain, such as identifying packaging alternatives that save on your bottom line. As retailers explore bringing supply chains entirely in-house, they will still need to package and move products. RPCs (reusable plastic containers) are the next-generation packaging solution specifically designed to optimize supply chains and save you money. “Vertical integration provides an opening to integrate innovative elements like RPCs into facilities at the time of construction or renovation, rather than retrofitting older facilities designed around corrugated packaging,” explains Eric Frank, Tosca’s president & CEO. Regardless of where your team may be in evolving your operations, our experts can help you uncover opportunities to improve efficiency and savings, and advance your sustainability goals.

Tosca’s complimentary supply chain analysis

No two supply chains are alike. Using our proprietary Supply Chain Optimization Model, we can calculate the precise impact RPCs would have on your supply chain. Developed by our supply chain and packaging experts, our model uncovers strategic opportunities to improve your bottom line. Whether you’re just getting started or looking for incremental ways to extract even more value from your integration efforts, we’re here with objective advice and new ideas as you think about what’s next for your business.

__

[1] https://corporate.walmart.com/newsroom/2019/04/24/walmart-to-create-angus-beef-supply-chain